Why Your Doctor or Nurse Might Not Be the Best Person to Ask About Medical Insurance and Who Is

Confused about your medical insurance? Learn why your doctor or nurse might not be the best person to ask and discover who can truly help you navigate the complexities of healthcare coverage.

The Frustration: Health Insurance Continued

As I mentioned in a previous article, open enrollment is fast approaching, and if you're from the United States, you know what that means. Just like early in every year, we do taxes, and later in every year, we do medical insurance. And signing up for medical benefits can be nearly as stressful and frustrating as doing taxes. As well as wholly like trying to make some significant life decisions based off of a pamphlet written in gibberish. At least, that is how I have felt about it for most of my adult life.

Though, I probably understand it better now than the average person, that is not true of most nurses or doctors. Every year, I spend some time helping colleagues try to understand and unravel their complex medical insurance questions, but I am still not much better off. And I do realize it is somewhat ironic that I'm saying nurses are not experts in medical insurance while writing about medical insurance. But I'd say I know enough to know I don't know enough and to be able to point out who does.

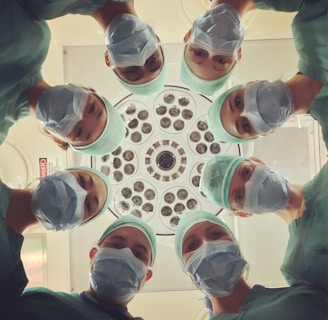

Because let's face it, when dealing with a health crisis, the last thing any of us wants is to worry about the intricacies of medical insurance. Unfortunately, I see it quite often that patients come into the hospital or medical office believing their doctors or nurses have the answers to questions such as, "will my insurance pay for this?" only to be met with limited knowledge or frustratingly vague responses only leading to worsened fear or anxiety for patients. So, let's nip the disappointment in the bud ahead of time. While we healthcare professionals are undoubtedly experts in our fields, we often lack the specialized training and time to navigate the complexities of insurance policies.

Understanding the Limitations of Healthcare Providers

As a nurse I'm primarily focused on providing quality medical care for my patients, and so are the doctors. Our time is dedicated to diagnosing and treating patients, not to deciphering insurance policies. We are often overwhelmed with patient appointments, paperwork, and administrative tasks. As a result, we may not have the resources, expertise, and time to provide detailed information about insurance coverage, copays, deductibles, and out-of-pocket costs. Let alone find the time to learn about them. Like I mentioned above, I see my fellow nurses struggle yearly to understand their own insurance policies.

Also, insurance policies can be incredibly complex, subject to frequent changes and updates, and no two policies are the same even if they come from the same parent insurance company. Keeping up with the latest regulations and guidelines can be a full-time job, even for those who specialize in insurance. Even though we health professionals see our patients struggle with the frustration of our inability to help them in regards to health insurance questions, it is just not realistic to expect healthcare providers to have a comprehensive understanding of this topic.

So, Who Can Help? The Insurance Experts

Though my experience is primarily in the hospital, if you're struggling to understand your medical insurance, sometimes there are patient care reps and administrators in the doctor's offices that work closely with the insurance companies and are a good resource to start with. If they don't have the answer, they generally know how to find it and can set you the right course. These people usually work the front desks registering patients or run the office. A good way to pose an insurance question to them I've found out is "Do you know how I can find out if my insurance ___?" and fill in the blank with your question about your medical insurance. Phrasing the question this way allows for them to either answer the question if they already know the answer or prompts them to help you figure out where/how to find the answer.

Also, there are several other individuals within medical offices and hospitals who can provide more assistance. They just may take a little more effort in contacting:

Billing Department: The billing department is a great resource. They deal with insurances directly and can often be the first point of contact for insurance questions outside the patient care area. They can often help you understand your bills, explain your coverage, and resolve any billing errors.

Insurance Coordinator: Many healthcare facilities have dedicated insurance coordinators who specialize in helping patients navigate their insurance plans. They can help provide information about copays, deductibles, and out-of-pocket costs, as well as assist with pre-authorization requests and appeals.

Social Services and Case Managers: These are highly educated and trained individuals that specialize in helping to coordinate patients' care during and after hospitalization. They often deal with insurances and help patients figure out what types of care they qualify for and how they will afford it. They also often work with other departments to coordinate charity relief or entities outside the hospital both public and private in regards to beneficial programs for patients.

Patient Advocate: Patient advocates are trained professionals who can help patients understand their rights and navigate the healthcare system. They can assist with insurance claims, appeals, and other complex issues.

If you are ever in doubt about your health insurance needs while at a medical facility, these are the people to really get a hold of. Often it is as easy as walking up to the nearest reception desk and asking for assistance in contacting them.

Beyond the Medical Facility: Insurance Brokers and Agents

However, If you're still having trouble finding the answers you need, consider reaching out to some really deep in the details experts of health insurance: insurance brokers or agents. These professionals' whole job is to specialize in insurance and can provide expert guidance on your specific needs.

Some of these agents work directly for the insurance companies. So, if you already have a healthcare insurance plan, reach out to your plan and talk to an agent. Part of their job is to help their clients, but oddly, I have not met too many people who really understood this. I can't tell you how many times in my career I've helped a patient turn over their medical insurance card to find the number to call on the back.

Several times in my career, after doing this, the patients and their families suddenly found themselves feeling empowered. They realized they no longer had to wait around in the hospital until someone like a case manager could figure out if some type of care was covered. The patients were able to contact their agents directly and find out the answer for themselves. I even watched an impromptu conference call between a patient, the case manager and the insurance agent take place in a patient room once because the patient had figured this out.

But, if you are in the market for a plan, insurance brokers and agents who work independently, can help you compare different plans, understand your coverage options, and negotiate with insurance companies on your behalf.

Some Tips for Finding a Reputable Insurance Broker or Agent:

Ask for recommendations: Talk to friends, family, or colleagues who have had positive experiences with insurance brokers.

Check credentials: Verify that the broker or agent is licensed and has the necessary certifications.

Interview multiple candidates: Meet with several brokers or agents to compare their services and find the best fit for your needs.

Ask about fees: Some brokers or agents charge a fee for their services, while others may earn commissions from insurance companies. Be clear about their compensation structure.

Taking Control of Your Healthcare

While it may be frustrating to encounter limitations when seeking information about your medical insurance, know that you are not alone. Most of us deal with this. Even we healthcare professionals deal with the exact same issues. We may be nurses and doctors, but we are also patients and so are our families. But, if we can all understand our options and learn to seek help from the right people, we can take control of our healthcare and ensure that we receive the care we need.

We all need to remember that our health is a priority. We all need to ask questions, seek clarification, and advocate for ourselves. By being informed and proactive, we can navigate the complexities of medical insurance and make the best decisions for our health and well-being.

Disclaimer: This article may contain affiliate links. This article is based on personal experience and the opinions of the writer(s). No information in this article may be taken as a substitute for personalized advice from an appropriately licensed healthcare professional.